Gamesys Group and Bally’s Corporation have announced that they expect to complete their merger in the final quarter of this year.

The two companies agreed to merge in March, with the agreement then signed last month.

Gamesys is expected to outline the full deal details in a document at the end of this month, with legal approval pending.

All looks set to go

Gamesys is paying £2 billion to acquire Bally’s, with the intention being to make the most of the US gambling market.

To raise funds, Gamesys was helped by a share offering worth $671 million.

The deal is subject to approval from the necessary regulators. Should they get the green light, Bally’s and Gamesys are expected to complete their merger in Q4 2021.

“A transformational step”

When the deal was initially agreed in March, Bally Chair Soo Kim discussed the significance of the partnership. He said:

We believe that this combination would mark a transformational step in our journey to become a leading integrated, omni-channel gaming company with a B2C business.

“We think that Gamesys’ proven technology platform alongside its highly respected and experienced management team, combined with the US market access that Bally’s provides, should allow the combined group to capitalise on the significant growth opportunities in the US sports betting and online markets.

“We are truly excited about the opportunities that this combination would offer and the enhanced and comprehensive experience and product offering that it would enable us to offer our customers.”

Bally’s announces Q1 2021 results

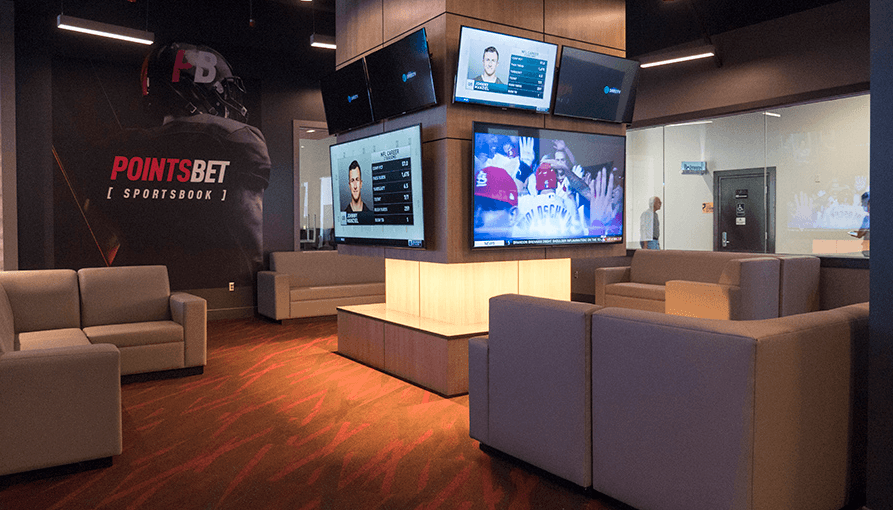

Bally’s operates over a dozen casinos throughout the US, including the Twin River Casino Hotel in Lincoln, Rhode Island.

Today, the company has announced its financial results from the first three months of 2021. Income from operations reached $29.5 million, which was the highest it has been since Q2 2019.

Meanwhile, the company also announced an adjusted EBITDA of $52.5 million. This was 137.9% higher than had been the case in Q1 last year.

Bally’s President and Chief Executive George Papanier said: “As we approach historical operating levels, we are encouraged by the performance at many of our properties this quarter, which when coupled with ongoing capital initiatives, offer tremendous growth opportunities and the potential to deliver strong results over the coming quarters.”