The US gambling giant Caesars Entertainment has its sights set on William Hill.

The US gambling giant Caesars Entertainment has outlined a possible cash offer for William Hill, saying it plans to make a bid worth £2.9bn ($3.71bn) for the UK sportsbook operator.

This comes after the sportsbook operator confirmed Caesars and the US private equity fund Apollo Global Management are competing to take over the bookmaker.

The bid from Caesars

Caesars’ offer would see the US gambling giant pay 272.0 pence for each share of William Hill, with the operator revealing it has finalised its due diligence and will make another announcement on the potential offer when it’s appropriate.

However, any offer is subject to the approval of William Hill’s shareholders, though the bookmaker’s board of directors has indicated that the proposed terms of the bid mean it would be minded to recommend accepting the offer.

The takeover bid would also be subject to customary antitrust and regulatory approvals in the US. Caesars said it would expect to secure the necessary approvals and complete the transaction in the second half of 2021.

Caesars’ chief executive Tom Reeg said: “The opportunity to combine our land based-casinos, sports betting and online gaming in the US is a truly exciting prospect. Hill’s sports betting expertise will complement Caesars’ current offering, enabling the combined group to better serve our customers in the fast growing US sports betting and online market.

“We look forward to working with William Hill to support future growth in the US by providing our customers with a superior and comprehensive experience across all areas of gaming, sports betting, and entertainment.”

In order to fund the acquisition, Caesars announced it would launch an equity capital raise with the proceeds being put towards the acquisition. Caesars said it would also use existing cash, as well as $2bn of new non-recourse debt facilities, which it plans to enter into and secure against William Hill’s non-US operations.

Caesars vs Apollo

The details of Caesar’s offer comes after William Hill revealed last week that both Caesars and Apollo put forward separate cash proposals to acquire the bookmaker.

William Hill explained that after it had received an initial written proposal from Apollo on 27 August, the operator received another offer from Apollo while Caesars made its own bid.

In the outline of its proposal, Caesars said that if Apollo were to acquire William Hill, Caesars would be entitled to terminate the rights associated with the joint venture it is engaged in with William Hill.

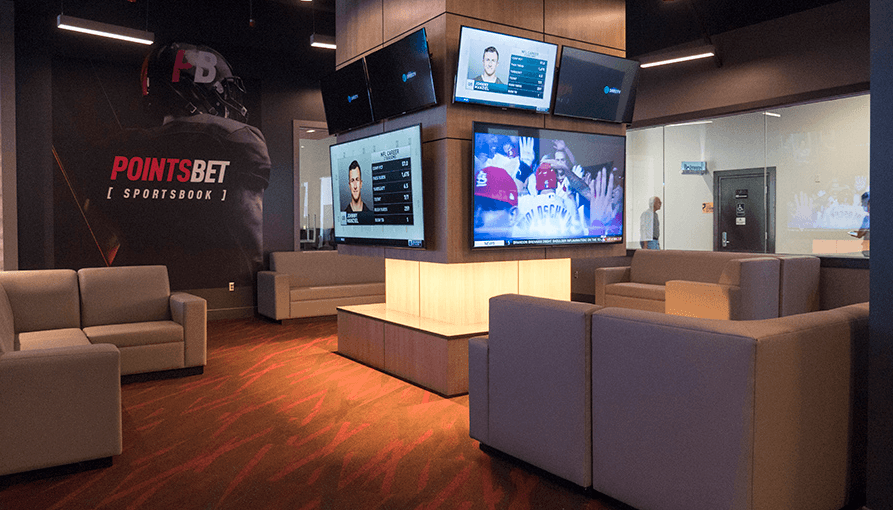

The joint venture between William Hill and Caesars allows William Hill to operate online sports betting through Caesars’ market access in states where the casino operator has a presence.

Caesars currently holds a 20% equity ownership in the venture, while William Hill holds 80%.

Caesars said that if William Hill were to take Apollo’s offer, it would terminate William Hill’s market access rights for online sports betting and the right to operate land-based sportsbooks at Caesars’ venues.

What does William Hill stand to gain?

William stands to make significant gains from a deal with Caesars. If William Hill accepts Caesars’ offer, the casino giant said it would seek to broaden the scope of its joint venture to maximise the opportunity in the US sports betting and online gambling space.

Looking at the benefits of the deal, Caesars said a combined operation would better serve customers in the US and increase its market access opportunities across the US. Caesars also said it would allow for a more unified customer experience by integrating applications and wallets.

Caesars said the combined business would have a “world-class” portfolio of assets and the ability to access Caesar’ existing partnerships with sports teams and events. This will include access to Caesars’ exclusive casino partnership with the NFL.

The casino operator also said this would allow for more alignment with US media organisations. At the time of writing, Caesars is engaged in a multi-year partnership with ESPN, while William Hill is partnered with CBS.

The news of the offer also comes after Caesars Entertainment was purchased by Eldorado Resorts in a reverse merger deal that created the largest casino and entertainment business in the US market.

This deal was announced in June 2019 and saw Elorado agree to pay $17.3bn made up of $7.2m and 77m Eldorado common shares in order to take over Caesars.